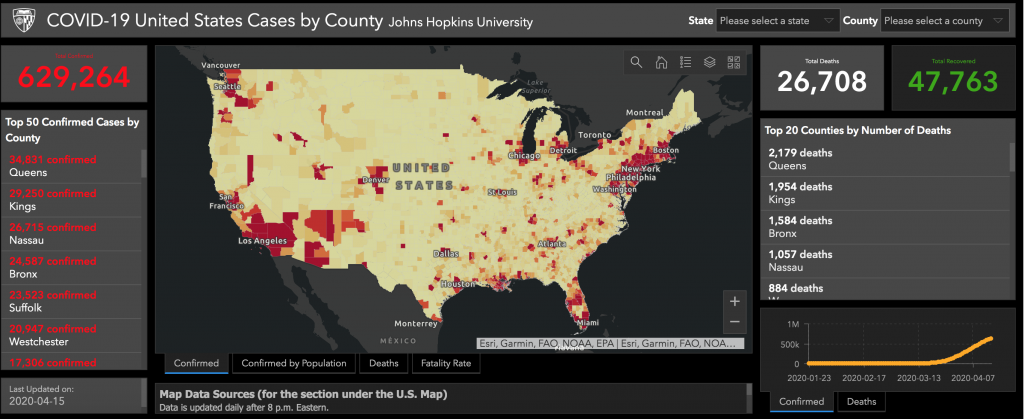

Reopening requires recalibrating expectations as brands and consumers seek ways to survive

Searches for the phrase “when will the economy open” jumped 450% this week, according to Google Trends, a data point that should come as no surprise to consumers and businesses impatiently waiting to read the official roadmap for return that scientists, economists, and politicians are all furiously working to craft.

Uncertainties about the impact of testing capacity, region-specific attitudes towards the virus, and the unintended human outcomes of lockdown fatigue all conspire to make it difficult to pinpoint exactly what awaits America once the mandated closures and bans begin to gradually lift and companies begin to restore operations – and get back to business. While we wait for the definitive plan, here are four themes marketers can use to navigate through the “fog of war” and prepare their own roadmaps to return.

Look to China for Insights

Marketers have hesitantly turned to China, and Asia more broadly, for guidance. According to a recent Coresight Research report, Nike and Lululemon’s experiences there offer clues about moving forward in uncertain times. Both brands pursued omnichannel strategies that enabled digital to pick up the slack while their stores were closed. Nike followed a four-phase playbook:

- Phase 1: Containment – 5-6 weeks with stores closed. Launched Nike app in China; connected with customers digitally around maintaining health and daily activities

- Phase 2: Recovery – Reopened 80% of the 7,000 brick-and-mortar Nike-owned and partner stores; customers returned to the stores wearing masks and practiced social distancing; focused on smooth omnichannel experiences between digital and in-store

- Phase 3: Normalization – Consumer traffic accelerated week-over-week; inventory declined from peak levels

- Phase 4: Return to Growth – Nike projects a return to growth in China by June; its app is seeing triple-digit growth

Others are trying to follow suit. Beleaguered “gig economy” companies like Uber, who’ve relied on delivery services to survive during an 80% revenue drop to their core business, have looked to Chinese company DiDi for insights.

During a webinar about the future of ride-hailing hosted by Silicon Valley website The Information, ride-hailing entrepreneurs shared how DiDi’s changes – like adding plastic dividers between front and back seats, taking extra sanitization steps after each ride and supporting a more diversified car fleet with multiple service tiers – presage the disquieting future of ride-hailing in America once we all are allowed outside.

Will Coleman, the founder of a Dallas-based ride-hailing and concierge service called Alto, expects the industry to move upscale, while shared-ride options disappear. “Customers will become more discerning and will pay a higher price for security and safety … it will be challenging for shared-ride models,” said Coleman, who noted that drivers are suffering the most during this downturn as the economics of the independent contractor model have unraveled.

Markus Villig, the founder of European ride-hailing service Bolt, offered more words of caution. “Will people even be able to afford an Uber in the future? Without low-cost options, cities are going to be stuck. But do you really want human density through public transportation? More driving will lead to congestion challenges – we need to find efficient, safe ways to move people.”

The Pandemic Pivot: Survive to Tell Your Story

For other businesses unable to see a path forward by looking overseas, the ability to pivot is buying them time and generating goodwill. In the troubled hotel industry, with millions of unoccupied rooms, companies are trying to hold on while giving back. According to Travel & Leisure magazine, Marriott launched a $10 million program called “Rooms for Responders”, which provides free rooms to healthcare professionals in parts of the country most affected.

Panera Bread started offering grocery delivery to make up for the lack of available delivery slots from Amazon and other essential delivery services. According to the NPD Group, restaurant transactions plunged 42% at the end of March compared to a year ago. As a result, Panera made the decision to convert its inventory of bread, dairy products and fresh produce into pop-up grocery stores. Such supply chain transitions are becoming more common, and help explain the initial shortage of toilet paper beyond just selfish hoarding.

Larger restaurant chains might weather the storm, but many smaller ones will not. Food & Wine published a moving essay mourning the loss of the diner’s lifestyle called, “To All the Restaurants I’ve Loved Before”, and noted that many of our most revered gourmet establishments will not reopen.

Direct-to-consumer companies, however, are proving nimble once again. After dipping their toes into physical store locations, many are retreating to their digital strengths or even turning to mail-order catalogs as a response to the current situation. In an eMarketer article about DTC responses to the pandemic, the founder of men’s apparel brand Vuori, Joe Kudla, discussed his new mindset.

“We’re focused on our e-commerce business. We’re increasing budget, shifting priorities and messaging to align with how our customers are living their lives while working from home,” said Kudla, who paused Vuori’s plans to open four new physical stores this year. “We’re focusing more on our web and mobile experiences, conveying … messages that resonate right now.”

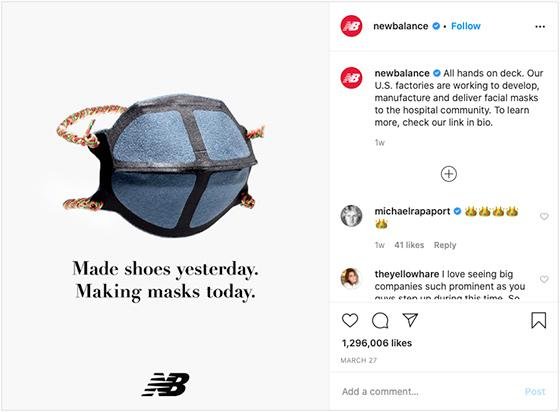

Shoe manufacturer New Balance joined the pandemic pivot by helping to make masks, as many other companies have followed similar approaches in their quest to market for good.

Ride the Zoom Boom: Exploit New Trends & Channels

Some companies and business models were ready-made for this crisis. Video teleconferencing services, animation shops that don’t require production sets, alcohol-delivery services, and nonprofit online educators, among others, are seeing the market move to them.

Zoom has become so ubiquitous with the WFH set, that marketers should consider using it as a new channel to drive awareness. Fast Company magazine, for example, created Zoom backgrounds that employees can use to show off during happy hours or other virtual gatherings. Expect Snap’s “Snap Camera” app to partner with more brands looking to explore the world’s newest digital billboard – your background.

Speaking of virtual happy hours, alcohol delivery app Drizly says it sales climbed 537% in the last week of March, with 42% of those orders coming from new accounts, according to Yahoo! Finance. For those who fear Drizly’s business model will lead to increases in alcohol addiction, there’s always an AA meeting over Zoom.

Commodify Your Consent: Creative brands are turning to Zoom backgrounds to gin up awareness. Put your head below the masthead and, voila, you are one of the most creative people in business!

Expect the Unexpected

The road to return will be bumpy. Fears of a fall resurgence loom, which only adds to a general sense of dread. For the first time since 9/11, many Americans are willing to trade away some level of privacy for a safe, contact-traced seat at an outdoor café. But until that magical day arrives when we can sit outside near other humans without fear, we will continue staying indoors, day after day, watching real-life episodes of the “The American Pandemic”.

In the face of such terrible television options, just how desperate has America become for this ordeal to end? So desperate that even mortal tech enemies Apple and Google have put aside their philosophical differences to form the unlikeliest of partnerships to co-develop contact tracing software that will help reopen cities. That’s a little something to give us all hope for the summer.